Second Annual VICIversary

Welcome to the Schmoozeletter Blog. Your source for weekly water cooler wisecracks from the world of finance. If you have an opinion different than mine or a topic you want to hear about, let me know!

This week, Mr. Market took another leg down as Trump’s on-again, off-again love affair with tariffs remains the big news.

One way to look at these tariffs is noble. Donny says they will remain due to these countries letting fentanyl into America.

American lives are at stake, Trudeau!

Oh, less than one percent of fentanyl comes from Canada?

Well, surely Trump doesn’t think us Americans are dumb enough to believe we’re setting the relationship on fire with our closest ally and trading partner due to nonexistent Canadian fentanyl.

1. He does.

2. We are.

I was able to get my hands on a pic of the border patrol up north, and they’ve apprehended a smuggler:

But enough mumbo jumbo! It’s party time!

This is the second annual Schmoozeletter VICIversary! Woo! Party hats and noisemakers. March 9th, 2023, was my first-ever purchase of everyone’s favorite real estate investment trust, VICI Properties. Two years ago, I entered the VICIverse at $33 per share.

“But Dave?!” you say. “$33 per share? It is now under $33. Why are you celebrating and not in the town square receiving twenty lashes for your tomfoolery?”

Well, faithful reader, it comes down to a little metric called ‘yield on cost’—a metric we will be tracking with real data fifty-two weeks from now in the third annual VICIversary and every year henceforth.

For each of those original shares at $33, which we will now affectionately dub the OG33, I received $1.695 in dividends over the past twelve months. The ‘yield on cost’ of the OG33 for this past year was 5.14% (1.695 / 33).

Dividends are straight cash, homie. You don’t need to wait for an arbitrary price target to sell your shares in order to get that sweet, sweet moolah. You don’t need to perfectly time a lunar landing to convert your digital gold into a currency you can buy ice with. C.R.E.A.M.

Next year, all I gotta do is sit on my fat butt and collect more cheddar. If VICI doesn’t increase their payments, next year I will receive $1.73 in dividends from the OG33. My ‘yield on cost’ would be 5.24% (1.73 / 33).

But here’s the part that has us poppin’ bottles—they do increase their dividend. They’ve increased it every year.

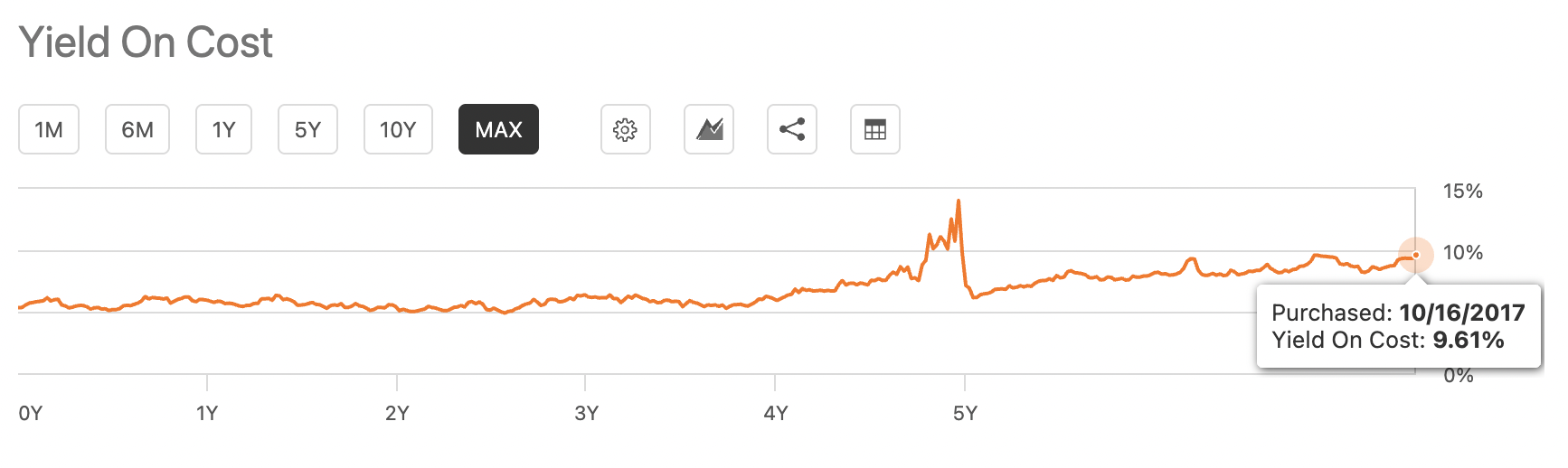

SeekingAlpha.com charts this metric on their website. They show how much VICI would have paid from buying in at different times. Buying in at their IPO in 2017 would have a ‘yield on cost’ of over 9% right now. Again, that’s straight dough just for doing nothing.

My guy Warren says the ideal holding period for an asset is a lifetime. He made his bills by buying exceptional companies and holding them for as long as they remain exceptional, collecting all those Benjamins from dividends along the way.

VICI is the rare blend of an exceptional company at a fair price with a high dividend yield.

Having a low starting yield makes sense for growing companies, which are using their extra capital to invest in themselves instead of paying it out to shareholders. But the ‘yield on cost’ can expand rapidly if the company continues to do well. A great example of this is Broadcom.

Seeking Alpha also charts the historical dividend yield. Ten years ago, Broadcom’s dividend yield was 1.0%. Today, the dividend yield is only 1.2%.

But the ‘yield on cost’ from ten years ago? Well, that is over 18%!

A purchase then would be paying back almost one-fifth of the investment every year. Had you bought $1,000 worth of AVGO in 2015, it would be paying you more than $188 over the past twelve months. It would pay even more bacon over the next twelve months—all for doing nothing at all.

This is why it is bad to make decisions strictly on current yields. The more important variable is potential growth. VICI is the atypical hybrid of high current yield, high potential growth, and high quality. Bow down to his royal highness.

So, am I batting an eye that the OG33 are down at SOS-32?

Let me hit you with a scenario. You live in a house. You like your house. You want to continue living in your house. A scummy contractor comes to the door and says, “Nice house. I’ll give you $5 for it.”

You would guffaw at this ridiculous offer. Why put yourself in a bind like that when you have a perfectly fine house that you intend to live in? The same logic applies to shares of exceptional companies.

As long-term investors, we relish times like these when shares are cheap. The yield at VICI’s current price over 5%. That’s more than a high-yield savings account. I am not only not selling, but I also have every intention of holding for forty-one years.

Now, I know what you are thinking, “You say a lot of crazy shit on this Creed-Thoughts-esque weekly poppycock, but forty-one years? How can you possibly project out over four decades, and why such a random number? If I had a rubber hose, I would beat you…”

Hold up. I didn’t pull forty-one years out of thin air. That is the weighted average lease term of VICI’s tenants. VICI is a landlord that owns real estate. Their tenants pay rent to occupy that real estate. It is written.

If forty-one years from now my Depends-wearing, wheelchair-bound self can roll down the Vegas Strip and the Venetian still has a gondola, then there is a chance I am still eating that VICI bread. You’ll be getting Schmoozeletters telepathically imported to the back of your eyelids by then, as Emperor Zuckerberg reigns supreme. But I digress.

Forty-one years is a bit ridiculous to project. But one year? Pretty safe to say they will increase the dividend again a year from now. Three years? Again, pretty confident. Ten years? I think so, but a lot can happen. Lucky for you, we’ll be having VICIversaries every year, so we will find out together.

Final Thought

“If you aren’t willing to own a stock for 10 years, don’t even think about owning it for 10 minutes.” – Warren Buffett